An overview of ‘People’s Money: Harnessing Digitalization to Finance a Sustainable Future’

Author: Diplo Team

On 26 August 2020, the Digital Finance Task Force (DFTF) launched its report entitled ‘People’s Money: Harnessing Digitalization to Finance a Sustainable Future’. The 100-plus-page document develops on the work of the UN High-Level Panel on Digital Cooperation and the recently published UN Secretary-General’s Report on Digital Cooperation by tackling the interplay between digitalisation, finance, and the 2030 Agenda for Sustainable Development. It does so by exploring some of the catalytic opportunities that could help secure funding the sustainable development goals (SDGs) and proposes a set of recommendations on how to address identified barriers and risks associated with digital finance.

Before delving deeper into the substance of the report, let us look at the launch itself attended by the UN Secretary-General Antonio Guterres, the DFTF co-chairs Ms Maria Ramos and Mr Achim Steiner as well as the DFTF members Mr Patrick Njoroge, Ms Natalie Jabangwe, Mr Eric Jing, and Ms Ceyla Pazarbasioglu.

The Launch

Digitalisation as a critical lifeline

Referring to the disruption of the global economy resulting from the COVID-19 pandemic, the UN Secretary-General Antonio Guterres noted that digital technologies such as mobile payments and crowdfunding are a critical lifeline that enables millions of people worldwide to preserve their livelihoods and receive government assistance. As such, technologies have the potential to become critical enablers in the Decade of Action and can help kickstart more resilient and inclusive communities.

On the occasion, the Secretary-General endorsed the DFTF’s citizen-centric approach to digital finance and echoed the DFTF’s vision of ensuring that digital finance becomes a force for good.

Addressing the barriers and risks

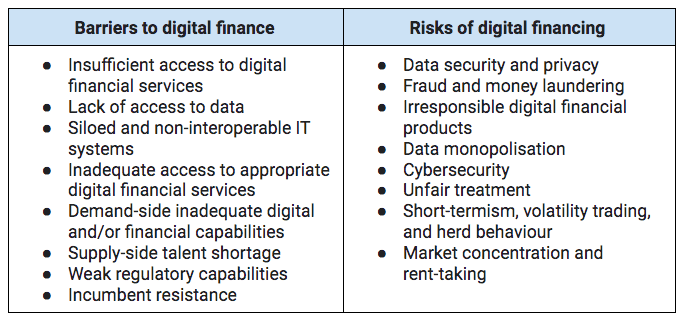

Despite the fact that the objective in mind is clear, a number of challenges stand in the way of harnessing the potential of digital transformation to achieve the SDGs. In this regard, the digital divide, namely, the lack of digital connectivity and inadequate digital infrastructure including IDs, ICTs, and payment systems were stressed by the discussants as the principal barriers to digital finance. Privacy violations and the absence of regulatory and legal capacity, for their part, were referred to as the potential risks arising from the increased adoption of digital solutions in finance.

Considering that digitalisation is not about the next gadget, but about the ecosystem, the DFTF members pointed out that efforts should be undertaken to mitigate such risk, whilst at the same time ensuring that they do not act as an obstacle to making the most of the opportunities of digital finance.

Regulating digital finance

The DFTF members agreed that people should be at the centre of financial regulation and any policy decision. They pointed to the need to secure people’s rights over their own data and data markets. Moreover, the need to develop international regulation inclusive of developing countries was highlighted.

A disconnect between the SDGs and national finance policies

The DFTF members also touched upon the existing gap between the SDGs, national finance policies, and ultimately Fintech-based innovation. While additional efforts are needed to bridge this divide, some action measures were cited including the World Bank Digital Economy for Africa Initiative that aims to improve the efficiency and transparency of financing development on the African continent.

Unpacking the report

Building on the need for ‘citizen-centric’ finance, the report contains key findings and recommendations developed by the DFTF since its launch in November 2018. It highlights the importance of digitalisation, in particular digitalisation of finance, brought to the forefront by the outbreak of COVID-19, and places sustainable development at the heart of finance transformation. Despite the fact that the global pandemic has been regarded as a fallback in progress on all 17 SDGs, the DFTF recognises the inherent need to leapfrog and make the most of the crisis.

Implementing the 2030 Agenda

The authors maintain that digitalisation can help overcome the setbacks to financing the SDGs through the impact of three interrelated features: more and better data that can contribute to better and more informed decision-making, reduced transaction and intermediation costs that enable broader access to financial services, and innovative digital business models for financing sustainability.

The report also identifies a number of barriers and puts forward recommendations on how to address the barriers and risks in the context of digital finance and the SDGs.

- In the context of barriers, it suggests a people-centric approach that empowers citizens, and to that end favours digital financial literacy programmes, improved access to information and greater transparency so as to increase the usage of digital financial services and citizen participation. At the national level, it endorses the development of a digital financing ecosystem through institutional arrangements while at the regional and international level it argues in favour of public-private cooperation in respect to governance, regulatory, and policy dialogue, as well as talent development and knowledge exchange.

- With regard to the risks, the DFTF proposes the securitisation of citizens’ rights and capabilities through, among other things, adequate consumer protection mechanisms, as well as enhanced supervisory practices. It also recommends strong data management and international cooperation on data governance issues in order to address the issue of data privacy and data monopolisation. It draws attention to developing countries that should be empowered to act in the governance of global digital financing platforms. Furthermore, the development of local regulatory and supervisory capabilities is suggested as a way of framing the digital financing ecosystem and ultimately addressing the challenges arising from digitalisation.

- Seven pathfinder initiatives are set out as illustrations of how the recommendations can be better implemented. The promotion of financial inclusion in the Gambia through an enabling policy environment and private sector investment in digital infrastructure and digital finance solutions is an example of one such a pathfinder initiative. Other initiatives include International Dialogue on Global Digital Finance that aims to incorporate the SDGs in digital finance policies and establish an inclusive space for cooperation and discussions on digital finance issues.

Task Force’s Action Agenda

The DFTF has also composed an Action Agenda consisting of three related sets of recommendations for government officials, international organisations, market players, and other stakeholders:

- Advancing catalytic opportunities to deliver financing for specific SDGs; five catalytic opportunities have been identified: channelling domestic savings into development financing, digitalising public financing along with its transparency and accountability, enhancing financing for SMEs, embedding the SDGs in financial & capital markets, enabling sustainable consumption choices;

- Build a foundation for a sustainable digital financing ecosystem (e.g. accessible digital infrastructure, digital IDs, data frameworks, adequate institutional mechanisms, capacity development);

- Strengthen inclusive international governance to develop principles, policies, and regulations to secure digital finance centred around the SDGs.