When we speak about investment diplomacy, we often think of countries working to attract foreign investment by creating a stable climate, offering incentives, and using diplomatic channels to build investor confidence. This is the traditional side, and it remains vital. Yet, investment diplomacy also flows in the opposite direction: countries investing abroad. Through sovereign wealth funds (SWFs), state-owned enterprises, or state-backed private companies, governments increasingly use outbound investments as tools to secure resources, strengthen alliances, and project soft power. In this sense, besides welcoming the capital, investment diplomacy is also about deploying it strategically across borders.

Investment diplomacy today goes beyond the basics of economic incentives and stable regulations. Countries now use investments to achieve broader goals: diversifying their economies, building soft power, and strengthening regional partnerships. This shows how financial resources have become important tools of foreign policy, connecting economics and diplomacy in new ways.

How Gulf sovereign wealth funds drive investment diplomacy

Gulf Cooperation Council (GCC) countries, Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman, have long been known for their huge oil and gas reserves and as places that attract a lot of foreign investment. However, in recent decades, they have transformed into significant global investors through their sovereign wealth funds (SWFs). These funds manage some of the largest assets in the world, with the UAE’s Mubadala Investment Company and Abu Dhabi Investment Authority (ADIA), Saudi Arabia’s Public Investment Fund (PIF), and Qatar Investment Authority (QIA) leading the charge.

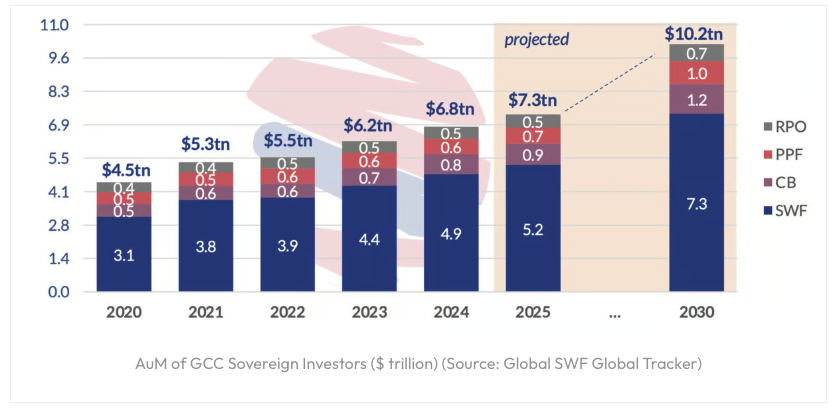

As of early 2025, GCC sovereign wealth funds collectively manage approximately $5 trillion in assets, with projections estimating growth to $7 trillion by 2030. Individually, Saudi Arabia’s PIF manages around $1.15 trillion, Abu Dhabi’s ADIA about $1.11 trillion, and Kuwait’s KIA just crossed $1 trillion. These funds account for roughly 40% of the global sovereign wealth fund assets, underscoring their dominant influence in the global financial world.

For instance, the UAE’s Mubadala expanded its renewables portfolio globally, contributing to climate goals and economic diversification. Saudi Arabia’s PIF has strategically invested billions in international technology firms and entertainment ventures, aligned with its Vision 2030 economic restructuring. PIF alone increased its assets by 29% in 2023, focusing on domestic infrastructure and real estate, and is targeting $2 trillion in assets by 2030, which would make it the largest sovereign wealth fund worldwide. Beyond economic returns, these investments serve diplomatic purposes. They stimulate bilateral relationships, promote cultural exchange, and position Gulf states as proactive contributors to global development. The UAE’s investments in cultural institutions, such as the Louvre Abu Dhabi, show how financial capital enhances soft power and national image.

Qatar’s sovereign wealth fund, the Qatar Investment Authority (QIA), managing assets exceeding $550 billion, shows how investment diplomacy creates real political influence. Beyond well-known investments in sports and luxury retail, Qatar’s portfolio spans sectors like telecommunications, healthcare, infrastructure, and renewable energy, particularly in Africa and Asia. These investments align with Qatar’s diplomatic efforts, helping it emerge as a global mediator and diplomatic hub. For example, Qatar has committed substantial investments in Central and Southern Africa in energy, mining, and digital infrastructure, which support both economic growth and strong bilateral ties critical to its diplomatic strategy.

Saudi Arabia’s PIF also plays a big diplomatic role through its regional investments. A key example is the 2016 agreement, where Egypt ceded two Red Sea islands to Saudi Arabia, a deal linked to Saudi investment and aid when Egypt was facing economic problems. More recently, Saudi Arabia offered to purchase the Ras Ghamila area, a prime Red Sea tourism site near Sharm El Sheikh, further deepening economic and diplomatic ties with Egypt. Additionally, Gulf SWFs hold investments in Egyptian ports, petrochemicals, and financial sectors, which aid Egypt’s economic recovery while expanding Gulf regional influence. The UAE’s ADQ fund and Qatar’s QIA are active in post-conflict markets like Iraq, investing billions in infrastructure, mining, agriculture, and financial services, supporting stabilisation and economic integration efforts.

These cases show how SWFs have become vital diplomatic tools, using their capital to strengthen partnerships and influence regional events.

New models of investment diplomacy

Another new trend is collaborative investment. For example, Masayoshi Son of SoftBank once proposed a joint US – Japan sovereign wealth fund to invest in advanced technology. The idea showed how allied countries can pool their resources to work on shared economic and security goals, strengthening their diplomatic ties through coordinated investment.

Similarly, regional integration efforts highlight how diplomatic missions are progressively focused on economic and investment diplomacy to promote trade and cooperation. For example, African countries are using special teams in their embassies to encourage foreign businesses to invest. This supports the African Continental Free Trade Area and shows how investment diplomacy can help bring countries together and boost regional development.

Infrastructure and investment diplomacy in action

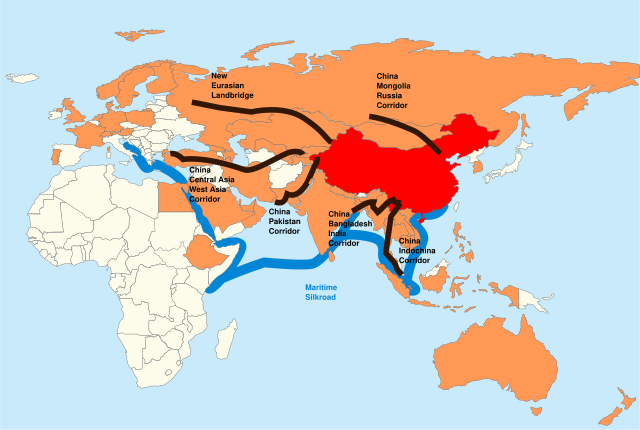

China’s Belt and Road Initiative (BRI) remains a high-profile case of investment diplomacy on a global scale. Launched in 2013, the BRI seeks to improve trade and stimulate economic growth across Asia, Africa, and Europe through infrastructure and investment. Despite certain criticism, it has undeniably contributed to improved infrastructure and greater economic integration in partner countries. China’s work in Afghanistan, for example, focuses on mining and infrastructure to help unlock the country’s mineral wealth and connect it to regional trade networks. This case illustrates how investments under the BRI umbrella can act as drivers of development and diplomatic ties, despite complex challenges.

The future of global investment and diplomacy

Investment diplomacy today is a two-way street. While countries have long sought to attract foreign investment, they are also sending their capital abroad to achieve strategic goals. The Gulf sovereign wealth funds are a perfect example of this shift, using their investments to diversify their economies and build international partnerships. Collaborative initiatives like the US – Japan fund and regional integration efforts highlight how pooled resources and diplomatic coordination can elevate shared interests. China’s Belt and Road Initiative further highlights the role of investment in addressing global challenges and promoting economic diplomacy.

It’s important to understand both the ways countries attract investment and the ways they invest abroad, especially when looking at how nations use money and business deals to build relationships and influence each other. This shows that financial activity goes beyond just making money, and that it’s also a key part of foreign policy and how countries connect in today’s world. As nations continue to deal with these complexities, investment diplomacy will remain an essential part of global strategy, blending economics and diplomacy to work toward development and stability.

Click to show page navigation!